Recently Nestle India rejected the proposal of increasing royalty payments to its Swiss parent company, Nestle SA. After this decision, Nestle India’s share price witnessed a significant jump. In this blog, we will explore the effects of this decision on the future financial prospects of Nestle India and its share price.

About Nestle India And The Royalty Rejection

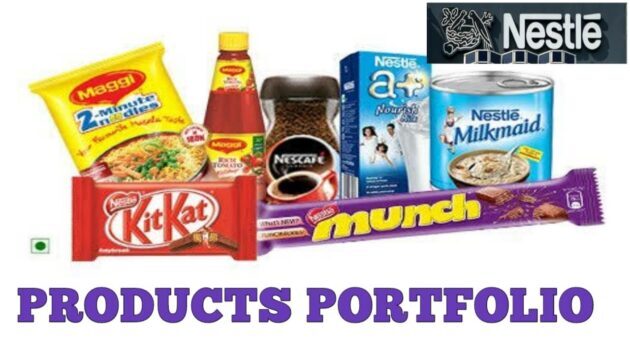

The Indian subsidiary of the Swiss-based Nestle SA. has had the agreement to pay royalties to the parent company for the use of its brand name, technology, and global expertise. Currently, Nestle India is paying 4.5% of Nestle India’s net sales as a royalty to its parent company in exchange for intellectual property (IP) rights, technical expertise, and brand usage.

However, Nestle SA proposed an increase in this royalty to 5.25%. This little increase is an extra outflow of money from Nestle India’s pocket. Thus this proposal was received negatively by a significantly large proportion (around 71 percent) of Nestle India’s public shareholders.

This resulted in Nestle’s share price intraday rise of 3.1% at Rs. 2503+ on the day of this announcement in May. At present, Nestle share price is trading above Rs. 2570+ as seen in the Nestle share price chart.

The Reasons Behind Shareholder Discontent

Several factors are behind this rejection from the shareholders. Some of them are:

- Profitability: The recent financial year shows a steady increase in profitability, with a 27% jump in profits and a 9% increase in revenue. According to shareholders, this royalty increase will decrease these profits, thus affecting the company’s growth and dividends.

- Transparency and Control: The parent company’s proposed royalty hike in an attempt to increase its standing and financial control over Nestle India’s management and operations. In contrast, shareholders wanted to put profits back into the Indian subsidiary so more research and new products could be designed.

- Valuation Impact: Higher royalty payout from Nestle India affects its valuation in the Indian stock market. This proposal of a royalty hike would make Nestle India less attractive to investors and ultimately affect the Nestle stock price.

The Impact of This Decision

The shareholders unanimously voted for the rejection of this proposal. This rejection had a direct and positive impact on the Nestle stock price. This rise in share price can be attributed to the following factors:

- Increased Profitability Potential: The profits that are retained by rejecting the proposal can be channeled into different fields like research and development, marketing and expansion of production capacity, etc. This results in increased operational efficiency, new products, and ultimately, a stronger financial performance for Nestle India.

- Enhanced Investor Confidence: The decision to prioritize shareholder value by retaining profits can help to increase investors’ confidence in the sustainable growth of Nestle India Ltd. Such sentiment can further result in a long-term upward trend of the Nestle stock price hence attracting more investment.

The Bottom Line

The share price of Nestle India has benefited in the short run from the rejection of the royalty hike. The way the company handles its association with Nestle SA and makes use of the retained income will determine the long-term effects.

To completely understand the impact of this decision on the Nestle stock price, investors need to keep a close eye on Nestle India’s financial performance, strategic decisions, and future interactions with its parent company.